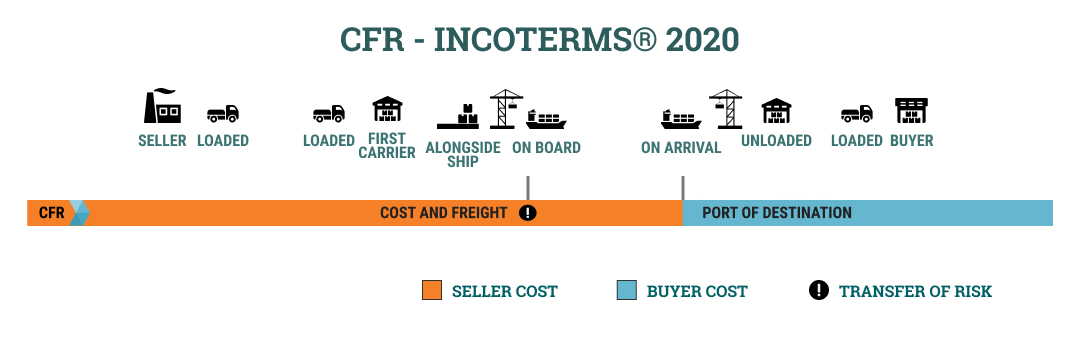

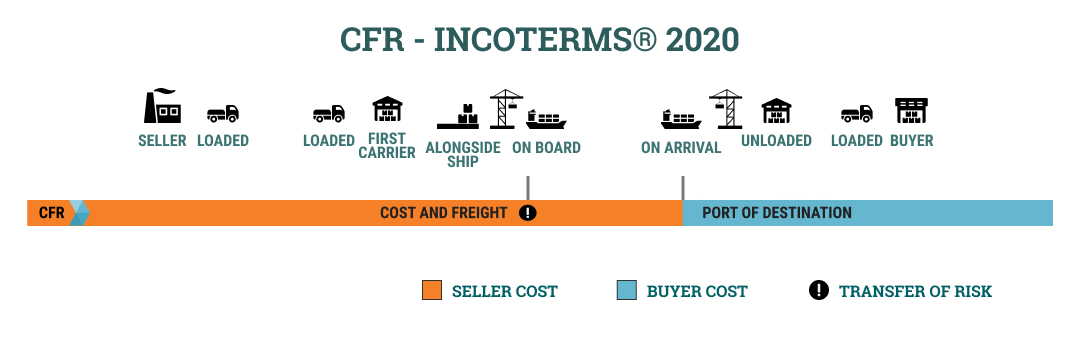

The terms of delivery of CFR Incoterms 2020 impose on the seller the obligations to place the goods on board the vessel and pay the costs and freight necessary to deliver the goods to the specified port of destination, as well as to carry out export customs procedures with payment of export duties and other fees in the country of departure for the export of goods. …

However, the seller is not obliged to comply with customs formalities for the import of goods, pay import customs duties, or perform other import customs procedures upon import.

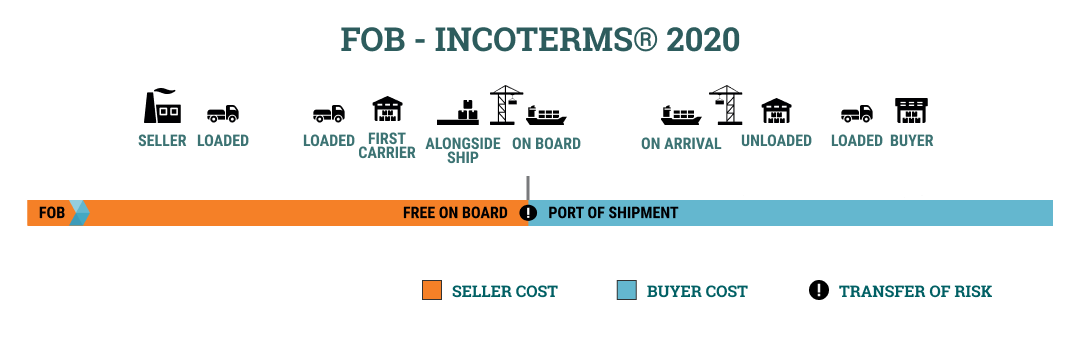

The buyer is obliged to unload the vessel hired by the seller at the port of arrival, carry out import customs clearance with payment of import customs duties and taxes, and deliver the goods to their destination. If the parties intend to impose on the buyer the obligation to deliver the goods by ship to the port of destination, it is advisable to use the FOB Incoterms 2020 rule.

The CFR delivery basis is relevant when transporting heavy equipment, for goods transported in bulk or in containers. When placing the goods in a container, it is typical for the seller to hand over the goods to the sea carrier at the terminal (or at the seller’s premises after loading the goods into the container), and not by placing them on board the ship, in such cases the term CPT Incoterms 2020 should be used.

According to the CFR delivery basis, the buyer assumes all risks of loss or damage to the goods, as well as other costs after the goods, have been placed on board the ship at the port of shipment, and not when the goods have reached their destination. The CFR trade term contains two critical clauses, as risk and cost pass in two different places: the risk on board the ship after a full load of goods, and the cost at the port of discharge.